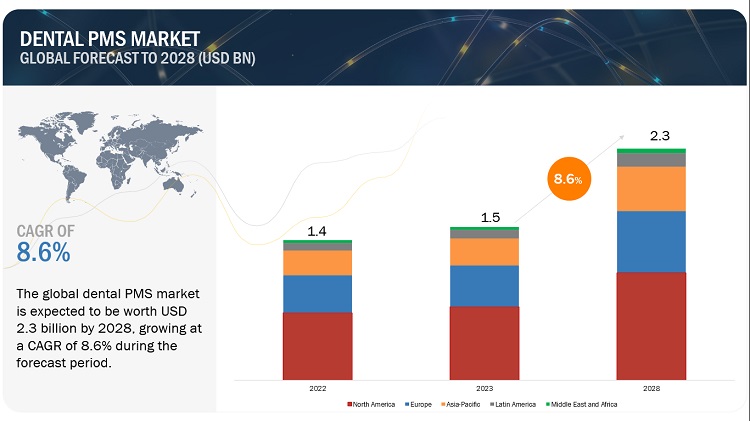

The Global Dental Practice Management Software Market in terms of revenue was estimated to be worth $1.5 billion in 2023 and is poised to reach $2.3 billion in 2028, growing at a CAGR of 8.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The rising awareness of oral hygiene and dental treatment, the increasing demand for advanced dental procedures, and the growing market for dental tourism in developing countries are major key drivers for the market. However, data privacy and security issues are the factors which may slow down market growth.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153532396

Dental Practice Management Software Industry Dynamics

Driver: Rising demand for advanced cosmetic dental procedures

Cosmetic dentistry is one of the fastest-growing segments in the dental industry. With increasing disposable incomes, the willingness to undergo expensive cosmetic procedures has increased, specifically among the aging population. While the demand for tooth whitening procedures has grown significantly, veneers, non-metallic inlays and onlays, dental crowns, and bonding agents are the most preferred cosmetic products.

Restraint: Data privacy and security issues

Electronic information exchange ensures quality care. However, it also raises the biggest challenge regarding the security of data. According to a survey from Software Advice, 90% of small-to-medium-sized dental practices utilize dental practice management software to manage patient data, billing, and insurance claims. Federal legislation such as the Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act are working to tackle the issue of data security. These security breaches and concerns over data privacy are expected to act as a restraint for the market.

Opportunity: Consolidation of dental practices

DSOs have shown rapid growth in recent years, especially in the US, the UK, Spain, and parts of Southeast Asia, including China. According to the American Dental Education Association Survey of the US Dental School Seniors, the percentage of young dentists willing to join DSOs has increased from 12% in 2015 to 37.7% in 2022. This number is expected to reach 61.5% by 2027.

In the UK, most of the largest DSOs (7 out of the top 10 DSOs) are backed by private-equity investors. Similarly, in the US, 27 out of the top 30 DSOs are backed by private equity. This helps DSOs achieve economies of scale through increased purchasing power and shared resources and invest in resources such as practice management software. Additionally, in the US, several states have passed legislation that allows non-dentists to own dental practices, which enabled DSOs to expand more rapidly.

The introduction of DSOs and their rising adoption by dentists worldwide are expected to offer significant growth opportunities for the market.

Challenge: Resistance to switch to dental PMS

The adoption of new technologies in dental practices, especially for practices operating in developing countries, is challenging. Dental professionals show resistance toward the implementation of newer dental technologies. This is in part due to the lack of funds and resources to adopt and manage new technologies, coupled with a lack of knowledge about the functioning of new technologies. The ability of many private clinics in developing countries to make investments is substantially lower than in developed countries.

Major Players:

Dental practice management software market include Patterson Companies, Inc. (US), Henry Schein, Inc. (US), Carestream Dental LLC (US), and Open Dental Software Inc.(US)

Request 10% Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=153532396

“During the forecast period, the cloud-based segment is expected to be the fastest growing segment of the Dental PMS industry.”

Based on deployment mode, the dental PMS market is segmented into cloud-based, web-based and on-premise software. The cloud based segment is forecasted to grow at the highest CAGR during the forecast period. The primary driver of this market is flexible, scalable, and affordable nature of cloud-based technology. Additionally, advantages such as remote access, low upront costs, and data security also contribute to the high growth of the segment.

“In 2022, by end user, dental clinics segment held the largest share of Dental PMS industry.”

By end user, the Dental PMS market can be segmented into hospitals, dental clinics and other end users.

Due to the rising awareness of dental disorders and their treatment, and the rising footfall in dental clinics in developing countries due to increased dental tourism, the dental clinics segment occupied the largest share of the market in 2022. The other end users segment is exected to grow at the highest CAGR during the forecast period. The growth of this segment, which is mainly due to DSOs, can be chalked down to increasing private equity funding for DSOs, and benefits of economies of scale offered by DSOs, among other factors.

“In 2022, Asia Pacific is expected to be the fastest growing segment in the Dental PMS industry during the forecast period“

Based on region, the dental PMS market is segmented into five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa.

Asia Pacific is expected to be the region with the highest CAGR from 2023 to 2028. This can be attributed to the rising dental tourism, rising disposable incomes, increasing awareness about new technologies, increasing prevalence of dental disorders, and rising need for quality dental care in the developing countries of the region.

Recent Developments of the Dental Practice Management Software Industry

- In January 2023 A Henry Schein, Inc. (US) subsidiary, eAssist Dental Solutions (US), acquired a majority interest in Unitas PPO Solutions (US) to improve fee analysis services offered by Henry Schein, and enhance the collection processes of the eAssist platform.

- In April 2023, Henry Schein, Inc. (US) acquired a majority ownership position in Biotech Dental SAS (France), aiming to create a digital workflow that provides a seamless journey for customers to increase case acceptance and improve clinical outcomes for practitioners.

- In November 2022, The Curve Dental LLC (US) and Pearl Inc. (US) organizations announced plans to integrate Pearl’s Second Opinion disease detection capabilities within Curve Dental’s all-in-one SuperHero practice management system.

- In February 2022, Straumann Group acquired a minority share (29.6%) in CareStack, which gradually increased to 36.3%. This enabled CareStack to expand its service offering and presence in the US.

Report Link: ( Dental Practice Management Software Market )

Dental Practice Management Software Market Advantages:

- Improved Efficiency: Dental practice management software automates various administrative tasks such as appointment scheduling, patient records management, and billing, reducing the need for manual paperwork and streamlining workflows. This improves overall efficiency, allowing dental professionals to focus more on patient care.

- Enhanced Patient Experience: The software enables seamless communication between dental staff and patients, offering features such as automated appointment reminders, patient portals for accessing information and making online payments, and secure messaging systems. These tools enhance patient engagement, satisfaction, and convenience.

- Accurate and Centralized Patient Records: Dental practice management software provides a centralized database for storing and managing patient records, including medical history, treatment plans, and diagnostic images. This allows for easy access to up-to-date patient information, improving accuracy in diagnoses, treatment planning, and continuity of care.

- Streamlined Billing and Insurance Claims: The software simplifies billing and insurance claim processes, reducing errors and improving accuracy. It automates the generation of invoices, tracks payments, and helps dental practices manage insurance claims efficiently, leading to faster reimbursement and improved revenue cycle management.

- Data Analytics and Reporting: Dental practice management software often includes robust reporting and analytics features that provide valuable insights into practice performance, financial metrics, patient demographics, and treatment outcomes. This data helps dentists make informed decisions, optimize practice operations, and identify areas for improvement.

- Compliance and Data Security: Dental practice management software ensures compliance with industry regulations such as HIPAA (Health Insurance Portability and Accountability Act) and provides data security measures to protect patient confidentiality and sensitive information.

- Integration with Digital Imaging and EHR Systems: Many dental practice management software solutions integrate with digital imaging systems and electronic health records (EHR), allowing for seamless access to radiographs, intraoral images, and other diagnostic data within the software platform. This integration enhances treatment planning and improves collaboration among dental professionals.

Overall, the adoption of dental practice management software offers numerous advantages, ranging from increased efficiency and patient satisfaction to improved financial management and data-driven decision-making. As the dental industry continues to embrace digital transformation, the dental practice management software market is expected to grow and evolve, providing even more advanced features and benefits to dental practices worldwide.

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

Research Insight: https://www.marketsandmarkets.com/ResearchInsight/dental-practice-management-software-market.asp

Visit Our Website: https://www.marketsandmarkets.com/

Content Source: https://www.marketsandmarkets.com/PressReleases/dental-practice-management-software.asp