India Dental Implants Industry Overview

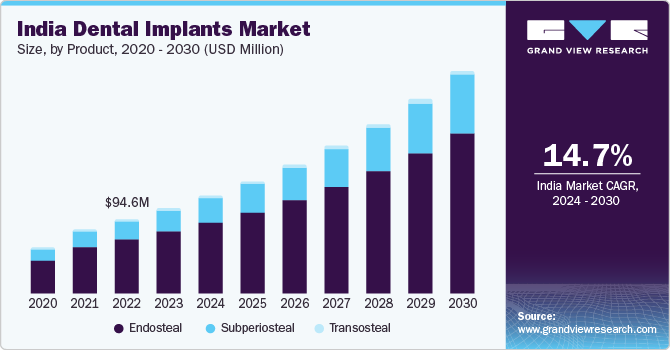

The India dental implants market size was valued at USD 108.6 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.7% from 2024 to 2030.

The market is growing due to the rising prevalence of dental caries and dental cancer, rising public awareness about oral health, and increasing access to dental practices. According to the Ministry of Health and Family Welfare, dental caries affects over 60% of the Indian population and periodontal disease affects nearly 85%. Moreover, India is regarded as the world capital for oral cancer.

Gather more insights about the market drivers, restrains and growth of the India Dental Implants Market

The demand for dental implants is growing due to the strategic expansions by key dental implant companies, and the national government initiatives, to promote oral health. For instance, the government of India established a goal to increase public oral health facilities per district by at least 50% by 2030 in the National Oral Health Policy, which was released in 2021.

However, after the second half of 2020, dental procedures began to restart, resulting in a full market recovery by 2021. Manufacturers such as Straumann, which offers a broad array of implants and implant solutions such as Neodent, Medentika, and Anthogyr, stated that their market share climbed from 27% to 29% between 2020 and 2021.

In India, dental caries is becoming more and more common. According to a study released in June 2021, Prevalence of Dental Caries in the Indian Population, the overall prevalence of dental caries was reported to be 54.16%, while age-specific prevalence was reported to be 62% in patients over the age of 18 and 52% in patients between the ages of 3 and 18.

Recent trends in India refer to an increase in oral health issues, with dental caries being the most common. Moreover, over the latter half of the previous century, dental caries have witnessed an upward surge in both prevalence and disease severity. Thus, the rising incidence of dental caries across India contributes to the rising demand for dental implants, which is anticipated to support market growth.

The growing adoption of computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies has resulted in the cost-effective production of dental implants. Dental professionals can enhance the experience and care of their patients owing to the growing use of advanced digital tools in standard procedures.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global fall detection systems market size was estimated at USD 447.18 million in 2023 and is projected to grow at a CAGR of 7.66% from 2024 to 2030.

- The global nucleic acid therapeutics CDMO market sizewas estimated at USD 13.53 billion in 2023 and is projected to grow at a CAGR of 14.10% from 2024 to 2030.

India Dental Implants Market Segmentation

Grand View Research has segmented the India dental implants market based on type, product, material, design, and end-use:

India Dental Implants Product Outlook (Revenue, USD Million, 2017 - 2030)

- Endosteal

- Subperiosteal

- Transosteal

India Dental Implants Type Outlook (Revenue, USD Million, 2017 - 2030)

- Non-premium

- Premium

India Dental Implants Material Outlook (Revenue, USD Million, 2017 - 2030)

- Titanium

- Zirconium

India Dental Implants Design Outlook (Revenue, USD Million, 2017 - 2030)

- Tapered Implants

- Parallel Walled Implants

India Dental Implants End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Dental Clinics

- Hospitals & Others

Key Companies profiled:

- Institut Straumann AG

- BioHorizons

- OSSTEM IMPLANT CO., LTD.

- Nobel Biocare Services AG

- Dentium Co. Ltd.

- MEGAGEN IMPLANT CO., LTD

- Zimmer Biomet

- Dentsply Sirona

- Alpha Dent Implants GmbH

Key India Dental Implants Company Insights

- November 2022, Investcorp, a Bahrain-based investment company confirmed USD 67 million investment in Asia's leading dental network Global Dental Services (GDS). It's Investcorp's fourth healthcare venture in India and it's first in the country's dental market.

- August 2021, Vatech, a key dental imaging device company, announced the opening of an e-commerce site in India for selling and distributing dental products. This move is part of Vatech's broader goal to diversify its commercial activities in the countries where it holds the highest market share.

Order a free sample PDF of the India Dental Implants Market Intelligence Study, published by Grand View Research.